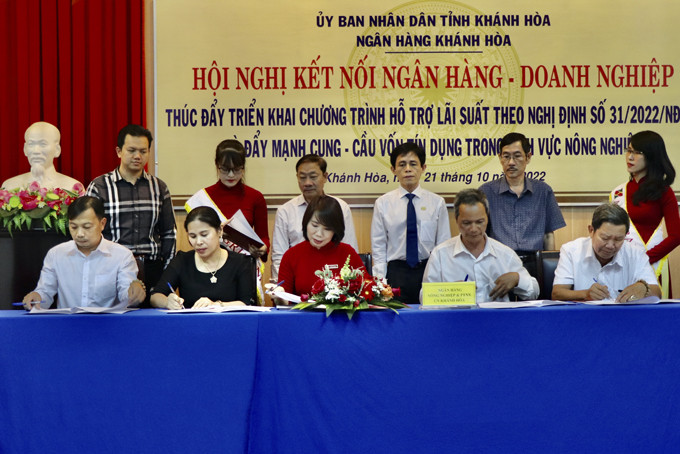

At the conference to connect banks and agricultural enterprises held by the State Bank of Vietnam (SBV) Khanh Hoa branch recently, banks signed a contract with 10 customers to provide capital of nearly 20 billion VND. Thereby, it shows that the banking is interested in promoting credit capital in the agriculture.

At the conference to connect banks and agricultural enterprises held by the State Bank of Vietnam (SBV) Khanh Hoa branch recently, banks signed a contract with 10 customers to provide capital of nearly 20 billion VND. Thereby, it shows that the banking is interested in promoting credit capital in the agriculture.

At the conference connecting banks and agricultural enterprises, Agribank Khanh Hoa signed contracts for 4 borrowers with a total capital of more than 10.5 billionVND; BIDV Khanh Hoa lent 3 customers more than 1.9 billion VND; Vietcombank Nha Trang lent 2 customers 4.3 billion VND; Sacombank Ninh Hoa lent 3 billion VND to 1 customer. In which, some customers have quite large loans, for example, Thuan fish cake business household: 5 billion VND; POMGROUP Production Trading Service Joint Stock Company: 3 billion VND; Tri Tin Co., Ltd. : 2.5 billion VND…

|

In order to promote credit capital into the agricultural and rural areas, the State Bank - Khanh Hoa branch has come up with many solutions. Accordingly, credit institutions continue to implement solutions to mobilize maximum capital on the spot, ensuring a balance with loan demand; closely combine the bank's credit policy with the State's industry and agriculture encouraging policy in rural areas; improve the lending method towards simplifying procedures and documents suitable for customers but still ensuring compliance with regulations... At the same time, credit institutions need to strengthen and improve the quality of credit connection programs between banks with businesses, banks with farms and cooperatives...

The banking has determined that connecting banks and customers is an effective solution to put credit capital into the life. In the coming time, Khanh Hoa banking will deploy regular, transparent and synchronous connections in districts, towns and cities with the participation of credit institutions according to the strengths of each bank.

According to a report by the State Bank of Khanh Hoa branch, as of September 30, the total outstanding loans for economic development reached more than 112,015 billion VND, outstanding loans to the agricultural sector of which reached 9,421 billion VND, accounting for 8,41% and raising by 12.42% compared to the figure at the end of 2021.

Mai Hoang

Translated by T.T